The new First-Time Home Buyer Incentive allows eligible first-time homebuyers, who have the minimum downpayment for an insured mortgage, to apply to finance a portion of their home purchase through a form of shared equity mortgage with the Government of Canada.

HOW IT WORKS:

- Lower Monthly Mortgage Payments

- Interest-free Incentive Program

- No Pre-payment Penalty homebuyer or their spouse

- Newly Constructed Homes eligible for 5% or 10%

- Existing Homes eligible for 5%

How do I know if I qualify for this incentive?

At least one homeowner must be a first-time homebuyer, which is considered as the following:

- You have never purchased a home before

- You have gone through a breakdown of marriage or common-law partnership (even if the other first-time home buyer requirements are not met)

- In the last 4 years you did not occupy a home that was occupied by the homebuyer or their spouse

How does my income affect qualifying for this incentive?

Your total qualifying income must be $120,000 per year or less. Remember you will still need to qualify the income requirements set out by lenders and mortgage loan insurers.

Do I still need Mortgage Loan Insurance?

Mortgages must be eligible for mortgage loan insurance through either Canada Guaranty, CMHC or Genworth. The first mortgage must be greater than 80% of the value of the property and is subject to a mortgage loan insurance premium.

The premium is based on the loan-to-value ratio of the first mortgage only. That is, the first mortgage amount divided by the purchase price. The Incentive amount is included with the total down payment.

Do I have to pay the government back?

The first-time homebuyer will be required to repay the Incentive amount after 25 years or when the property is sold, whichever comes first.

The homebuyer can also repay the Incentive in full at any time, without a pre-payment penalty. Refinancing of the first mortgage will not trigger repayment.

How is repayment calculated?

Repayment is based on the property’s fair market value at the point in time where repayment is required. If you receive the 5% Incentive, you will pay 5% of the home’s current market value. If you received 10%, you will pay 10% of the home’s current market value.

Does this affect the type of property I can purchase?

Yes, there are some guidelines for the type of property, and the intention of ownership.

Eligible residential properties include:

- New construction

- Re-sale home

- New and re-sale mobile/manufactured homes

Residential properties can include 1 to 4 units.

Types of residential properties include:

- Single family homes

- Semi-detached homes

- Duplex

- Triplex

- Fourplex

- Town houses

- Condominium units

Depending on the eligible property type, the Government of Canada will offer 5% for a first-time buyer’s purchase of a re-sale home, and 5% or 10% for a first-time buyer’s purchase of a new construction.

The property must be located in Canada and must be suitable and available for full-time, year-round occupancy. Additionally, you can NOT purchase the home with the intention of renting, as investment properties are not eligible.

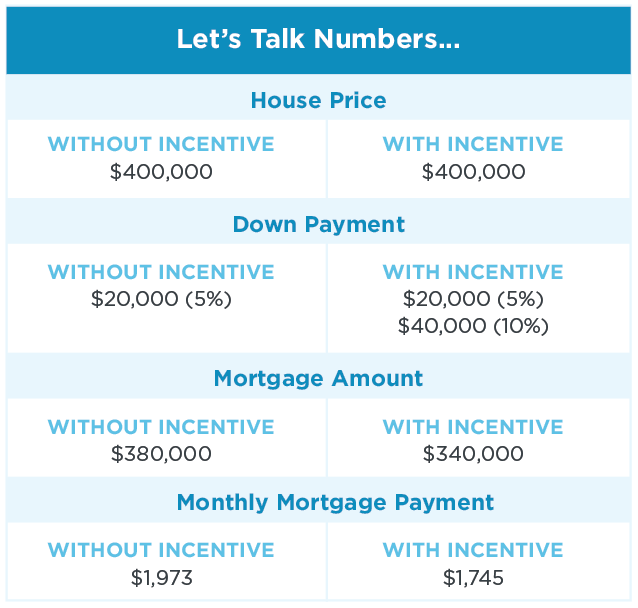

Without this new incentive, if you only have 5% down payment, your mortgage would be 95% of the purchase price plus the mandatory default insurance premium. Default insurance premiums are larger when you have a smaller down payment. With the new incentive, you now have up to 15% down payment (5% your own and 10% incentive) so your mortgage size is smaller and the insurance premium is also lower because the down payment is higher.

CHART BASED ON A NEW CONSTRUCTION 10% QUALIFIED SHARED EQUITY MORTGAGE, THIS CHART DOES NOT REFLECT MORTGAGE DEFAULT INSURANCE PREMIUMS. FOR ILLUSTRATIVE PURPOSES ONLY.